THE 5 STEP GUIDE TO INVESTING IN ART

[a 7 minute read]

$300 million and appreciating.

‘When will you marry? Gauguin asks as he paints.

A Middle Eastern investor paid $300 million for these Tahitian beauties.

What does it takes to invest in art? How do you make sure you get something that is meaningful for you? And valuable?

There are 5 steps to this.

What is art in the first place?

It’s the expression of human creativity and dreams. It may be of nightmares, this is human too. It’s our spirit in action. Art goes back to our cave-man days. We have many more ways to be creative today. Painting, sculpture, performance, installation. Real life and digital.

It’s pleasure. It’s style. It’s investment. It’s status.

Which leads to the next question

Why would you want to invest in art? How much should you pay for it?

THE FIVE STEPS TO INVEST IN ART

Traditional art

Step 1: Work out why you like art

For example: you may want… art can do all of these:

- color on the wall or to fill in a space – decoration

- remind you what you’ve achieved – recognition

- uplifts you, gets conversations started – inspiration

- represent your values visibly – culture

- make money – investment

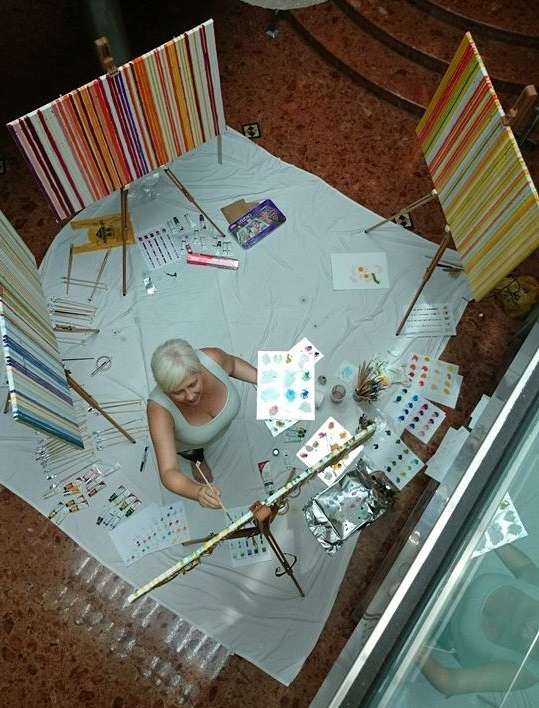

Booth Aster in her studio

Step 2: Work out where you can get it

For example: you can get art from…

- your family inheritance

- shows/exhibitions/events

- art galleries

- collectors

- artists

Reach out to collectors. Go to galleries. Take a friend and explore. Find an opening and join in. Wear comfortable shoes. As a bonus, this is great exercise. You’ll get your 10,000 steps for the day done.

Online art galleries are now global. If you are seriously interested in a piece, look at a large high resolution file. The thumb nail is not the same as the original. Just like a photo of your beloved is not the same as having them there with you. Online is a great way of finding the right piece that is not in your location.

Get invited to visit an artist in their creative space.

I had a sculpture master class with Choon Boon Kee, one of China’s leading sculpturers, in his studio. Amazing. BA.

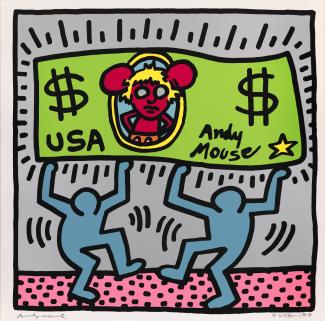

Keith Haring 1986 from the Andy Mouse Portfolio

Step 3: Research aka go take a look

At this stage, you are looking for:

Step 3a: what fits in the theme and message of your collection, including what you like

Step 3b: where you can find it + do you respect the source

Step 3c: what it will take financially

This can be and is fun. Explore. Go to new places. Take a friend and have fun discussion what you see. Art is personal. So you’ll like some and hate others. It’s cool. Be social.

Buy for passion with a view for investment

Art is sold in three ways. Most people invest in art through one of these:

- Artist you get to see and hear about what’s behind the work, what else they have going on, what it takes to create that piece. You know it is genuine work.

- Gallery who represents the artist selling you directly. Convenient if you don’t know artists that you enjoy and value.

- Broker who buys art to sell when the price goes up. Some galleries and collectors operate this way.

Art as appreciation, art as investment.

Insights from global research.

- 6% global growth even with China USA trade disputes

- Growing Millennial Asian market

- Lagging gender diversity in art works purchased

- Increasing number of million dollar artworks in primary market sales

UBS: The Art Market 2019

Deloitte: Art & Finance Report 2017

Step 4: Work out your investment budget

Art is an investment as it can be resold at a potentially higher price and something you use through enjoyment. Art prices ranges hugely. From a tens of dollars to millions of dollars.

So why does the price range so much?

Many factors go into ‘why it costs what it does’. Here are the main elements:

- materials used

- time it takes to create

- message the work(s) is about

- uniqueness in the concept

- scarcity ie is there only 1 like this or are there 10? Or 500?

- part of a series or standalone. A full set of a series has extra value

Three questions to consider as you invest:

- Is the artist established – works in galleries, shown internationally, in collections or museums? Are they in brand creating conversations?

- If you are looking at investment: what the demand is? is there a market for it? Will it appreciate over time?

- If you are looking at it for you – that it speaks to you.

Some people care about technique – back in the day Gauguin painted on burlap in a rough style that was considered unfinished. These days, it is worth $300 million.

Step 5: Do it… get your art!

Pick your piece… it may be small, it may be huge. It may be a full series. Get started with the artist.

The clue to act: Where you feel. Oh, wow, I’m here with something that has meaning, magic and mystery.

This is what great art does.

Have it packed and insured for safe delivery.

Vibrations in situ

concept

BONUS: Put it up on your board room, hallways or as a statement piece in your foyer

Use art as a means to connect with those who you value … Have your story ready… people always have their opinions… and they usually ask ‘What is it about’, ‘why do you like it’?. They’ll give you their opinion. They may even ask what you paid.

When I invest in art, I create my own story about it.

- This piece speaks to me because… This may be about the story of the painting/sculpture or that it is a brilliant reminder of a major life decision or achievement.

- When I see it, it does xxx… eg makes me joyful, reminds me to be courageous.

Then I ask them… what do they see… as we each see something different.

Do this and you’ll be a brilliant conversationalist, investor and art appreciator!

Enjoy your art and your investment,

Photocredits:

Will you marry me, Gaugain. Photographer unknown

Artist in studio

Photograper: Rainer Zimmerman